Stefan Kobel

,

Kobel's Art Weekly 22 2024

Kira Kramer visited the Arco Lisboa with its 80 exhibitors for the FAZ: “The architecture of the narrow but 400 metre long Cordoaria Nacional requires the exhibitors to line up like pearls on a string. Two curated sections and a post-colonial focus set the tone at the fair. In addition to the strong presence of female artists, the high proportion of women on the curatorial and management committees is striking. Most of the galleries come from Spain and Portugal, but dealers from France and Brazil are also well represented.” So it's business as usual in Lisbon.

Patrick Drahi knows a lot about debt. The auction house Sotheby's, which he took over in 2019 for 3.7 billion dollars, has now developed a new product with which it bundles its loans granted against art as collateral totalling 700 million US dollars and lends them out itself. Tim Schneider explains the Sotheby's ArtFi Master Trust, Series 2024-1 Asset-Backed Notes in his usual detail for The Art Newspaper. If all goes well, the art market could perhaps drag the financial industry down with it in the next crash instead of the other way round, as happened in 2008.

Ronald Perelman, currently only 1764th on the Forbes list, sold art for just under one billion US dollars between 2020 and 2022 following a bad investment, Karen K. Ho at Artnews summarises a report by Tom Maloney for Bloomberg Law (paywall).

The Guardian headlines that Damien Hirst has backdated at least 1,000 works of art. (Ursula Scheer from the FAZ offers a retelling in German). Meave McClenaghan spoke to five insiders who testified that of the 10,000 dotted paintings in ‘The Currency’ project, many times more were probably not produced in 2016 as stated, but in 2018. During the 2021 campaign, buyers were able to choose whether they wanted the physical work or the corresponding NFT after a one-year holding period. It is therefore an edition, albeit of 10,000 unique pieces. This is different from assigning monumental sculptures or large canvases to an important work phase retrospectively and thus potentially increasing their value. Elke Buhr explains this very well in an interview with Max Oppel for Deutschlandfunk: ‘It won't do him any harm because his reputation is already ruined anyway.’ Ultimately, the newspaper is making a mountain out of a molehill, and many other media follow suit. The entire discussion could have been avoided. Whether some, half or even more of the dot paintings were produced in 2016 or in subsequent years is ultimately of little interest, as the date range is not particularly wide and only very few, if any, were painted by Hirst himself. Furthermore - and this is the real crux of the matter - they are only one side of ‘The Currency’, the other part consists of the NFTs that were inextricably linked to the physical works. And these are undoubtedly from 2021, which would make this year the correct date of creation. The only stupid thing is that Hirst apparently insisted that all of the works on paper were created in 2016. Once again, this doesn't make the master look good.

New blockchain, new luck: Now that NFT has become something of a dirty word, new possibilities are opening up, Katya Kazakina has researched for Artnet (paywall) : “Nevertheless, now that digital art can be minted on Bitcoin (before this was only done on Ethereum), some believe that there is the potential to bring different factions together again. Bitcoin-minted art is referred to as Ordinals, and with the market up, this is the space that feels like it has opportunities. Sotheby's is particularly keen to embrace them. ‘Ordinals has opened up to a whole new audience of Bitcoiners,’ said Sotheby's head of digital art and NFTs, Michael Bouhanna. ‘There are people who are just on this one chain, so this shift has suddenly brought a new market, new collectors and we've done a few very successful sales selling Ordinals.’”

A report by Daniel AJ Sokolov on heise online about a particularly bizarre judgement by the Cologne Regional Court regarding a photo wallpaper on a picture on the internet suggests that copyright law seems to be in a bit of a mess: “In order to cover some of the care costs, the granddaughter takes over grandma's house and rents it out as a holiday flat. The woman advertises the flat on the Internet. Eight years later, she suddenly receives a warning letter from a Canadian company demanding money: the website shows a photo of a room with the photo wallpaper stuck to the wall.” The judgement against the heiress of the photo wallpaper is not an isolated case: “It's no wonder that the Cologne Regional Court has already had to rule on at least four similar lawsuits: in Germany, plaintiffs who claim an infringement of their intellectual property rights on the Internet are free to choose which court they appeal to. And the Regional Court of Cologne has made a name for itself for lawsuits brought by photo wallpaper photographers.” Just as the Hamburg Regional Court is particularly inclined to penalise alleged violations of personal rights by the press. Or the Jülich Local Court the reporting of data leaks.

Oliver Koerner von Gustorf at Monopol holds up a mirror to the bigoted spaceship that is the art world - with himself on board: “Nobody, neither the 'activist' philanthropists, nor the artists, curators, theorists or authors who provide the superstructure, really believes that the ruling class is interested in changing conditions. Nobody believes in this boutique cure that is being demonstrated. Nobody believes that the mainstream art scene is on the side of the ‘working class’, that it can or wants to change its hierarchical, above all economically dictated structures. Nevertheless, this boring story persists that good people want to change the system with art.”

Brita Sachs describes the efforts of the private Buchheim Museum to conduct provenance research in the FAZ: “Since 2017, provenance researcher Johanne Lisewski has been examining the museum's holdings and making the results of her research and digitised source material available on a database. The initial situation is difficult: there are neither inventory lists nor accession books, but instead Buchheim's library with 60 linear metres of auction catalogues, as well as 130 linear metres of unorganised documents that occasionally reveal chance finds such as an invoice or a letter. Apart from that, provenance research here, as everywhere else, resembles a paper chase in which stamps, labels, half-erased inscriptions, etc. have to be traced.”

Hans-Christian Rößler reports the recovery of the fourth of a total of five paintings by Francis Bacon stolen in Madrid for the FAZ.

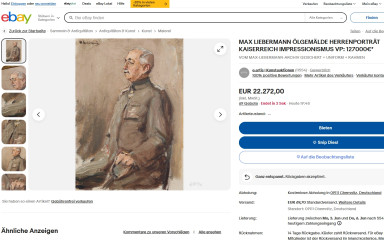

Ebay is suitable for trading in high-priced works of art after all. 22.272 Euros has now realised a signed oil sketch by Max Liebermann on the German side of the online marketplace. The seller cited an auction result of 127,000 euros achieved at Karl & Faber in Munich in 2022 as the ‘comparative price’. However, the catalogue there contains a complete provenance as well as a reference to an agreement with the estate in accordance with the Washington Agreement. The commercial eBay seller merely states ‘private collection Southern Germany’ as the provenance and says: ‘The work has been inspected and is not listed as lost art.’ That could be difficult in the event of a resale, bargain or not.

Swantje Karich is moving from WeLT to Der Spiegel, according to a press release: ‘Karich, born in 1978, has been deputy head of the features section of “Welt” and “Welt am Sonntag” since 2021. After nine years as an editor in the features section of the ‘Frankfurter Allgemeine Zeitung’, she moved to Berlin in 2014 to take over the art section of the daily and weekly newspaper and set up the magazine ‘Blau’ as deputy editor-in-chief.’ At Faz, she was a mainstay of art market reporting under Rose-Maria Gropp. At Der Spiegel, she is to expand the opinion and debate section together with three other new additions.

Sotheby's is losing its “global chairman and head of global fine art” Brooke Lampley to Gagosian, reports Katya Kazakina on Artnet.

Tessa Solomon reports the closure of the David Lewis gallery in New York, which regularly participates in Frieze and Art Basel on Artnews.

In an Instagram post Nino Mier announces the closure of his Los Angeles locations. His gallery will keep operating from New York and Brussels.

semi-automatically translated