Stefan Kobel

,

Kobel's Art Weekly 30 2024

Devorah Lauter has analysed how smaller and mid-size galleries are dealing with the current market weakness for Artnews: “For these smaller and mid-size galleries, however, the slowdown makes the calculus around fairs trickier, particularly when you consider the overhead for a fair. As multiple dealers told ARTnews, shipping, framing, storage, and other overhead costs have risen dramatically, with [gallerist Monique] Meloche suggesting that such costs are ‘at least 50 percent higher’ than pre-Covid. Those costs are felt by collectors too, who Meloche said continue to gravitate towards paintings, due to the efficacy in those costs."

Georgina Adams tries to find out what the British art market can expect under the Labour government for The Art Newspaper: “Eva Langret, the artistic director of Frieze London, is a little less positive. ‘There are so many things on the agenda for the new government,’ she says: ‘I fear that it can't give priority to art and culture, that will come behind many other issues that are more pressing, but I am hopeful for change.”

Rosalind Jana tries to explain the art world's enthusiasm for the fashion industry at ArtReview: “The artworld, too, does a fair amount of cloaking: investment and speculation and the sky-rocketing financial success of a series of ultra-contemporary artists justified by the perceived nobility of the form. Right now, this seems to have resulted in a lot of woozy abstract paintings (or worse, something described in every accompanying text as ‘abstraction meets figuration’), and perhaps a nagging sense, shared with the fashion world, of existential ennui about what it's all for - where to find the pleasure and provocation, beyond making money and being seen at the right parties. Bedfellows in their anxieties as well as their mutual admiration and need, perhaps fashion and art are not so much clasping hands but clinging to each other in the dark."

However, Melanie Gerlis believes in The Art Newspaper that there is no way around the fraternisation with entertainment, luxury and fashion: “Smaller art businesses, including commercial galleries, can choose to ignore the art-as-luxury consumer and continue serving their niche audiences. But bigger businesses-including auction houses, art fairs and museums-know that they need luxury brands' financial support and connections to more geographically diverse and younger crowds, as well as their capacity to please ever-demanding regulars. Witness Hauser & Wirth's sister business of hotels, restaurants and private-member clubs, or the launch of Art Basel's first ‘concept store’ at this year's fair. (Biscuits for $56 seems to go beyond the category of ‘necessary’."

Tokyo Gendai was not a roaring success in its second edition either, observes Sarah Douglas for Artnews: “While some have hoped that a weak yen right now might encourage foreign collectors to travel, as ARTnews Karen K. Ho reported earlier this week, there was not a large contingent of collectors from the United States or Europe. However, that's not really this fair's brief. [Director Magnus] Renfrew is more focussed on attracting collectors from the region. He did, however, say, ‘In an ideal world, we would want to be able to attract a wider audience from around the world, and I think that there could be the potential to do that.”

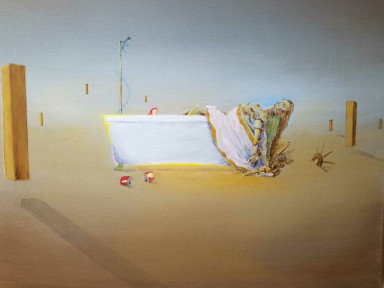

Werner Remm visited the mini fair Art Bad Gastein for Artmagazine: “Even though Art Bad Gastein is still considered an insider tip in international art fair tourism, the participants were consistently satisfied with the first sales after the opening weekend. This may also be due to the fact that the acceptance of summer art projects has now increased among the population."

In his half-year review for the Handelsblatt, Christian Herchenröder can also take some positives from the weakening international art market: “The art markets in the first half of 2024 were characterised by a slowdown, consolidation and business as usual. One sign of consolidation is the renunciation of speculation in the top market segment of Impressionist, Modern and Contemporary art. The scepticism of collector-investors, which was already noticeable last autumn, has intensified. One sign of this is the last-minute withdrawal of top lots from the auctions, such as a diptych by Brice Marden estimated at Christie's at 30 to 50 million dollars or a ‘Buste de femme’ by Pablo Picasso valued at 12 to 15 million dollars at Phillips. A pronounced fear of heights remains. But it is an element of stability because it prevents overheating in important market sectors."

Susanne Schreiber followed Christie's conference call on its half-year results for the Handelsblatt: "Christie's CEO Guillaume Cerutti's video call with trade journalists had one message above all: to spread calm and confidence at a time when auction sales have plummeted. Between January and June 2024, this fell by 22 per cent to 2.1 billion dollars. In the same period last year, it was still 2.7 billion dollars. This is due to the challenging macroeconomic environment, wars, crises and uncertainty factors. A number of collectors willing to sell had therefore withdrawn their consignments and postponed them until the autumn. Nevertheless, Cerutti emphasises, not without pride: ‘Christie's performance was stable. That means there is no reason to panic." Ursula Scheer commented in the FAZ on 20 July: “His word in God's ear, those who currently fear for their jobs at the international auction house or its competitors may think, because the company's figures announced at a press conference point clearly downwards”. Christie's should actually be able to ride out the current market situation, as the company belongs to the empire of François Pinault, who, according to Forbes, is currently the 73rd richest person in the world.

Meanwhile, Sotheby's is enhancing its Paris location by acquiring a prestigious property, reports Stephanie Dieckvoss in the Handelsblatt: “It seems as if owner Patrick Drahi places more value on first-class buildings than on employees. As if he relies more on the potential of property than on expertise. Sotheby's is opening new premises in Hong Kong in July. Next year, it will move into the Breuer Building in New York, which was long home to the Whitney Museum of American Art. And now it has invested in a large property in the heart of Paris. It remains to be seen whether this calculation will work out in the ailing auction business, which is often described as a ‘people business’."

Is it due to the art market situation, the London location or the declining interest in Old Masters? The report by Gina Thomas for the FAZ on the relevant auctions certainly sounds sobering: “Even though Christie's was able to achieve robust results with a stronger offering, the events at both houses were tough. The majority of the paintings sold fell short of the lower estimate or were knocked down below it. Christie's total turnover of around 44 million pounds was also below the estimated margin. Sotheby's realised less than £12.4 million with 26 of 32 lots sold, not least because a pair of Canaletto's Venice vedutas were withdrawn, probably due to lack of interest. The Sotheby's auctioneer tried to encourage bidders with the refrain that the buyer's premium on the hammer price had been reduced by 26 per cent." Stephanie Dieckvoss gives a more positive view in the Handelsblatt: “The auctions of Old Master art and artefacts in London are not exciting, but the news is consistently good. This shows not only that London continues to be a successful marketplace for historical art, but also that the market for Old Masters is active with a fresh supply. The problem is supply, not demand. Buyers from Europe in particular continue to be targeted."

According to Susanne Schreiber in the Handelsblatt, German auction houses are doing well: “At the end of a robust spring auction, Van Ham is reporting brilliant figures, as expected. Like Germany's top auction house Ketterer, Van Ham is on the upswing and is defying the trend towards restraint. With a total result of around 26 million euros in the first half of 2024, Managing Director Markus Eisenbeis sees himself in second place in the national ranking. [...] The position at the top of the German auction houses is once again held by Ketterer Kunst. The Munich-based company is reluctant to disclose much on request, but only this much: with valuable books, private sales and all art auctions, the total turnover for the first half of the year was 54 million euros. The evening auction at the beginning of June alone brought in 40.6 million euros."

Sabine Spindler takes a look at the results of the Asian art auctions at Lempertz, Nagel and Koller for the Handelsblatt.

Kasper König is having a large part of his collection auctioned off in Cologne at the end of the year. Christiane Fricke spoke to the auctioneer and collector for the Handelsblatt: “For Van Ham boss Markus Eisenbeis, what goes under the hammer is 'a personal reflection' of a life with art and artists, many of whom are friends of the exhibition organiser. Perhaps this bond is one of the reasons why the following sentence is uttered during the conversation with König: ‘As a rule, an auction is terrible. Yet sentimentality is actually the last thing you would expect from Kasper König. He's too clever for that and the business side of things is too close to him." The museum man explains his motives in an interview with Georg Imdahl for the FAZ: “He realises, König explains in his own diction, 'that an auction house is 'super, super capitalistic’, it's about ‘selling and selling again'. But he wanted to avoid at all costs that his four children, his wife and his grandchildren, who are to receive the proceeds, could have interpersonal differences about the allocation of the works. No less important to König is this note: all artists would be informed of the auction in advance. They could veto the auction if they did not wish to participate, in which case their works would be returned to them. Either way, the Cologne auction and the life story will further round off König's work as a player in the art world."

In her summary of the rather average auction season in Switzerland for the FAZ, Felicitas Rhan mentions some bad news in passing: “There was no postponement, but a permanent cancellation at the Swiss branch of Sotheby's in Zurich: a spokesperson for the house announced that the auction date for Swiss art in June has been cancelled - due to a decline in consignments. There was no information yet on the annual December auction of Swiss art."

Careful scrutiny of consignments by auction houses should be a matter of course, at least since the forgery scandals of the recent past, but Hubertus Butin is nevertheless forced to demand this in the FAZ, as he demonstrates with current examples: “Works in particular that were considered lost or were previously inaccessible must not be summarily equated with the published object. If the author of the catalogue raisonné is not given the opportunity to inspect the work himself, the vendor's statement that an original has been discovered here is nothing more than a dubious claim."

Olga Kronsteiner complains in the Standard that the Vienna Dorotheum may have problems complying with money laundering regulations in terms of customer identification: “However, research suggests that the auction house is more likely to comply with the legal requirements than to fulfil them: A weak point in the prevention of money laundering and terrorist financing, but above all with regard to possible manipulation, as experts involved in the matter confirm. [...] Why is all this relevant? Leonard Rosen does not exist, he is a fictitious ‘German citizen’ who registered as a customer at Dorotheum and overcame the identity check with an AI-generated driving licence, the authenticity of which was not checked at all. Confronted with these facts and the associated criticism, the auction house reacted cautiously: It ‘will investigate and press criminal charges’ - on the basis of which criminal offence remains unclear."

The Klassik Stiftung Weimar, the Dresden State Art Collections and the Prussian Cultural Heritage Foundation jointly acquired Caspar David Friedrich's sketchbook, which was auctioned by Grisebach at the end of last year for 1.8 million euros including buyer's premium, but was subsequently placed on the list of national cultural assets. Susanne Schreiber explains in the Handelsblatt: “In consultation with the owner, Grisebach then arranged the acquisition by the three museums specialising in Caspar David Friedrich. Anyone who followed the auction in November knows that the purchase price must be between 1.4 million and 1.8 million euros. Germany's most important patrons, the Ernst von Siemens Art Foundation and the Cultural Foundation of the Federal States, as well as other sponsors, provided the main funds. When the agreement with the museum trio became apparent, the owner abandoned his legal action." Ursula Scheer comments critically in the FAZ: “The proclaimed model character is likely to trigger mixed feelings in the local art trade and among collectors who are flirting with the idea of selling works that may have national identity-forming significance. In fact, the completed change of ownership of the sketchbook is not only a precedent for cultural co-operation in the service of the general public, but also for how the Cultural Property Act can serve as a lever for the expansion of public collections. [...] Whether the notebook with Friedrich's preparatory studies for paintings is actually of identity-forming rank for the cultural nation and whether it must be kept in Germany can still be discussed, but is de facto decided."

Sophia Kishkovsky reports on Russia's art theft in Ukraine in The Art Newspaper: “Shortly before Kherson's liberation in November 2022, residents raised the alarm that Russian troops had taken truckloads of art from the museum to Simferopol in Crimea, the Black Sea peninsula that Russia illegally annexed from Ukraine in 2014. Russian state television news footage from September 2023 showed Andrei Malgin, the director of the Central Museum of Taurida in Simferopol, with some of the works, which he claimed were being held temporarily for safekeeping. The Art Newspaper spoke with Dotsenko, who remains the official director recognised by Ukraine and has returned to Kherson, about the latest efforts to identify and recover the museum's missing art."

semi-automatically translated