Stefan Kobel

,

Kobel's Art Weekly 48 2023

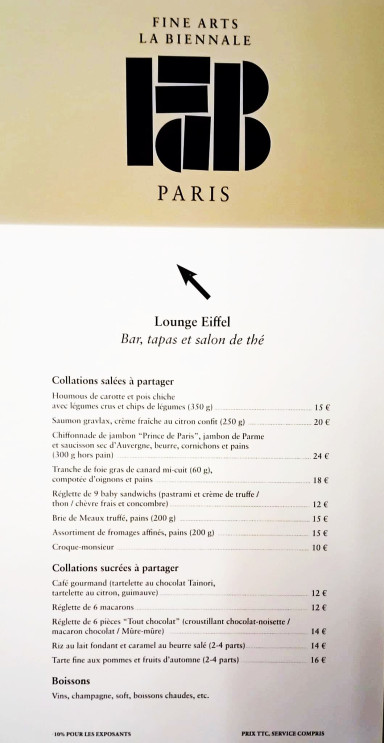

With the FAB Paris, Paris finally has a brilliant art and antiques fair in the Grand Palais (Éphémère) again, which Bettina Wohlfarth visited for the FAZ: "After several years of gruelling competition, the two Parisian art and antiques fairs merged last year under the name Fine Arts Paris & La Biennale. The quarrelling association of French art dealers withdrew from the organisation, which was taken over by the operator Agence d'Évènements Culturels. The company, which also organises the Salon du Dessin, is owned by nine art dealers and the luxury group LVMH. [...] This second edition confirms the success of the merger. Under the new, now definitive name 'FAB Paris' - the acronym refers to the merger, but also to a euphoric fabulous - a self-confident fair is already emerging. In the busy trade fair calendar, the right strategy and an advantageous time slot are essential for survival. The London Masterpiece had to throw in the towel last summer due to a lack of participants." I visited the trade fair for the Handelsblatt.

In the announcement of its first fully-fledged edition after the pandemic, Art Basel Hong Kong reveals a stronger focus on the region, I suggest in the Handelsblatt.

Trends and insights arising from the New York autumn auctions are summarised by Artnet News: "One reason for the less-than-stellar results from the auction season was the rash of withdrawals that plagued all three houses over the course of the two-week marathon. Sotheby's notably slim modern art evening sale, which began with 41 lots (compared to Christie's 65-lot offering) got even thinner as the night went on. In previous seasons when consignors decided to withdraw lots, it was typically accompanied by a presale proclamation. Despite the confident posturing of the auctioneer, a bevy of hasty mid-sale announcements this year revealed an atmosphere of uncertainty. A startling eight works-which amounts to 20 per cent of the sale-were withdrawn. "

With expertise and an eye for the bigger picture, Christian Herchenröder succeeds in providing insights into the art market for the Handelsblatt, even on the basis of supposedly less exciting auctions, in this case on the occasion of the auction of Old Master art at Lempertz in Cologne: "The first lot of the auction, the panel painting of a Madonna and Child by a late Gothic master from southern Germany, was acquired by a London gallery for contemporary art for 27,720 euros. This is also part of a change in taste. There are more and more galleries and, above all, artists who are acquiring one or two works of old art, while the regular audience in this sector is made up of either old or very young buyers. The relevant trade, which was less successful at this year's fairs than in 2022, is holding back strongly - as the London and New York auctions also show. At Lempertz, it is always Belgian collectors who characterise sales with striking bids."

The readjustment of the European auction market can also be seen in the new head of the Contemporary division at the Dorotheum in Vienna, who Nina Schedlmayer introduces in the Handelsblatt: "He only left his former employer partly for personal reasons. He also talks about how Brexit and its new customs regulations changed the London marketplace. It wasn't just tax barriers that played a role, but also those in people's minds. 'If someone from Germany wants to sell a work, they ask themselves why they should export it to London,' he explains. 'After all, it's a bit more complex and expensive. The German market has developed very strongly, 'including the auction houses. Grisebach used to be the top dog, but now others have gained in importance - Ketterer, for example, has risen to the top. While these houses used to compete even more strongly with Sotheby's, Brexit has now given them a boost, according to his observations."

The looming collapse of Rene Benko's Signa empire could bring some high-calibre works of art back onto the market, Rainer Fleckl and Sebastian Reinhart have researched for the Austrian portal News: "As several insiders confirmed to NEWS and the German news magazine 'Spiegel', this concerns the painting 'L'Étreinte' by Pablo Picasso and a self-portrait from 1988 by the artist Jean-Michel Basquiat. Both works were acquired by a private foundation of Benko's in 2021 and became part of a larger private collection. In 2021, the renowned auction house Christies sold Picasso's work for just under 17 million euros and Basquiat's for around 10 million euros. Due to the enormous time pressure, another international auction is out of the question." However, the loss of Signa as a cultural sponsor is unlikely to mean a major loss, Olga Kronsteiner found out for the Standard: "Signa will 'not become more successful through sponsorship', Benko remarked in 2010. At the time, there was talk of an 'annual cultural million' from the holding company. The Albertina also benefited from this temporarily, with Signa transferring 500,000 euros as an 'annual partner' until 2012. It ended after three years. What remained was the Bank Austria Art Forum, which - like the Constitutional Court - is housed in the Signa property on Freyung in Vienna. These days, they are very optimistic. Even if the building were to be sold, the long-term lease would protect the company from a relocation scenario."

Isa Genzken leads Monopol's Top 100 (paywall), after Nan Goldin topped the list last year. In second place, the documenta curatorial collective Ruangrupa is replaced by artificial intelligence: "Artificial intelligence, which according to Monopol touches on the core of human existence and identity, is in second place on the list. The new Art Basel team, the artists Nicole Eisenman, Rosemarie Trockel and Hito Steyerl, the artists Henry Taylor and Isaac Julien as well as the curators and museum directors Klaus Biesenbach, Max Hollein and Hans Ulrich Obrist are also represented in the top 20 of the large Monopol ranking." Timo Feldhaus explains the decision.

Isa Genzken's world receiver, which was sold very cheaply at Bares für Rares, does not have to be returned to the artist or her legal guardian after all, reports Felix Bayer in the Spiegel: "According to the 'General-Anzeiger' and 'Kölnische Rundschau' newspapers, citing a court spokesperson, an application for a temporary injunction was filed with the Bonn Regional Court at the beginning of November, but this was rejected by a civil court judge. According to the judge, the nurse had at least 'appropriated' the work of art: He had taken possession of it in good faith and kept it. He had not received a request to return it within ten years. The applicants could lodge an appeal against the Bonn judge's decision, which would then have to be decided by the Cologne Higher Regional Court. However, Isa Genzken's legal guardian told SPIEGEL on Thursday afternoon that he would not appeal against the Bonn district court's decision." The article leaves open whether this means that the purchase contract concluded in the ZDF programme is valid again, or whether the nurse can now sell the sculpture at a realistic price.

Clementine Kügler reports the closure of the Juana de Aizpuru Gallery in the FAZ: "Even during the Franco dictatorship, Juana de Aizpuru started a gallery in Seville, which existed from 1970 to 2004, to promote artists who were rather frowned upon in grey Spain. In 1982, she founded the ARCO art fair in Madrid, which quickly attracted a large audience. A year later, the Galería Juana de Aizpuru opened in the centre of Madrid on Calle Barquillo."

The New York gallery Cheim & Read - also jokingly known as Crime & Greed among colleagues - announced its closure via Instagram, after the gallery had already briefly closed to the public in 2018. Director and partner Maria Bueno plans to trade with blue chip artists as a private dealer with her new company Bueno & Co. Theo Belci says goodbye in The Art Newspaper.

We finally know who Banksy is, believes Carita Rizzo in Rolling Stone.

semi-automatically translated